When buying and financing real estate, the market value of rented real estate is important to know. Lenders only want to finance part of the value. If you are considering buying a property or if you want to extract equity from your investment property, the market value in a rented state will usually have to be determined by an independent appraiser.

What is market value in rented condition?

The value of real estate is important when purchasing, but also for financing with the help of a buy-to-let mortgage. Lenders want to provide the vast majority of the value to a mortgage. They often maintain a maximum of 70% to 80% of the value (LTV: Loan to Value). The value that the lender uses for this is called the market value in rented condition.

The estimated amount for which real estate under lease between a willing buyer, other than the tenant, and a willing seller, after proper marketing, would be transferred in an arm’s length transaction on the valuation date, the parties being knowledgeable, prudent and would have acted under duress.

Dutch Tax authorities and investment property in leased condition

The market value in rented condition is also an important term that is used by the tax authorities in the income tax return. This involves stating the value of the assets in box 3. From 2010, the WOZ value is important for the value of investment properties that are an asset in box 3. In the case of real estate rented out to private individuals subject to rent protection, the letting is a value-depressing factor on the sales value and therefore also on the WOZ value. The basis for this is the best possible estimate of the possible sale price on the valuation date determined by an official of the municipality where the property is located. You can request the current value of this via the WOZ-waardeloket, via MijnOverheid or by asking the municipality. For this reason, the so-called vacant value ratio is taken into account when determining the market value of let real estate. The value of the house is set at a percentage of the WOZ value, whereby the value is linked to the amount of the rent. The vacant value ratio calculation may only be applied when the investment property is let to tenants who benefit from rent protection.

Why is the rental value less than the normal value?

The market value in a rented state is often lower because the rented property can only be sold including the current lease. With a tenant in the property, a new buyer cannot live in the property himself or rent it out to someone else. The reason for a lower value is, among other things, the fact that the number of potential buyers of a rented house is considerably smaller than that of the number of buyers of a house free of rent and use. The market is smaller and with it the demand. As a result, the value is often 20% lower than the normal market value. In other words, 80% of the regular value.

Although the valuation is lower, it is still possible to finance leased real estate.

The lender engages an appraiser to estimate the value in leased condition. Based on knowledge of the market, expertise and collected data from comparable properties, for example, an appraiser can provide a reliable assessment of the market value in a rented condition. This gives the lender the comfort that the chance of unexpected surprises is limited and that it is possible to finance part of the investment property.

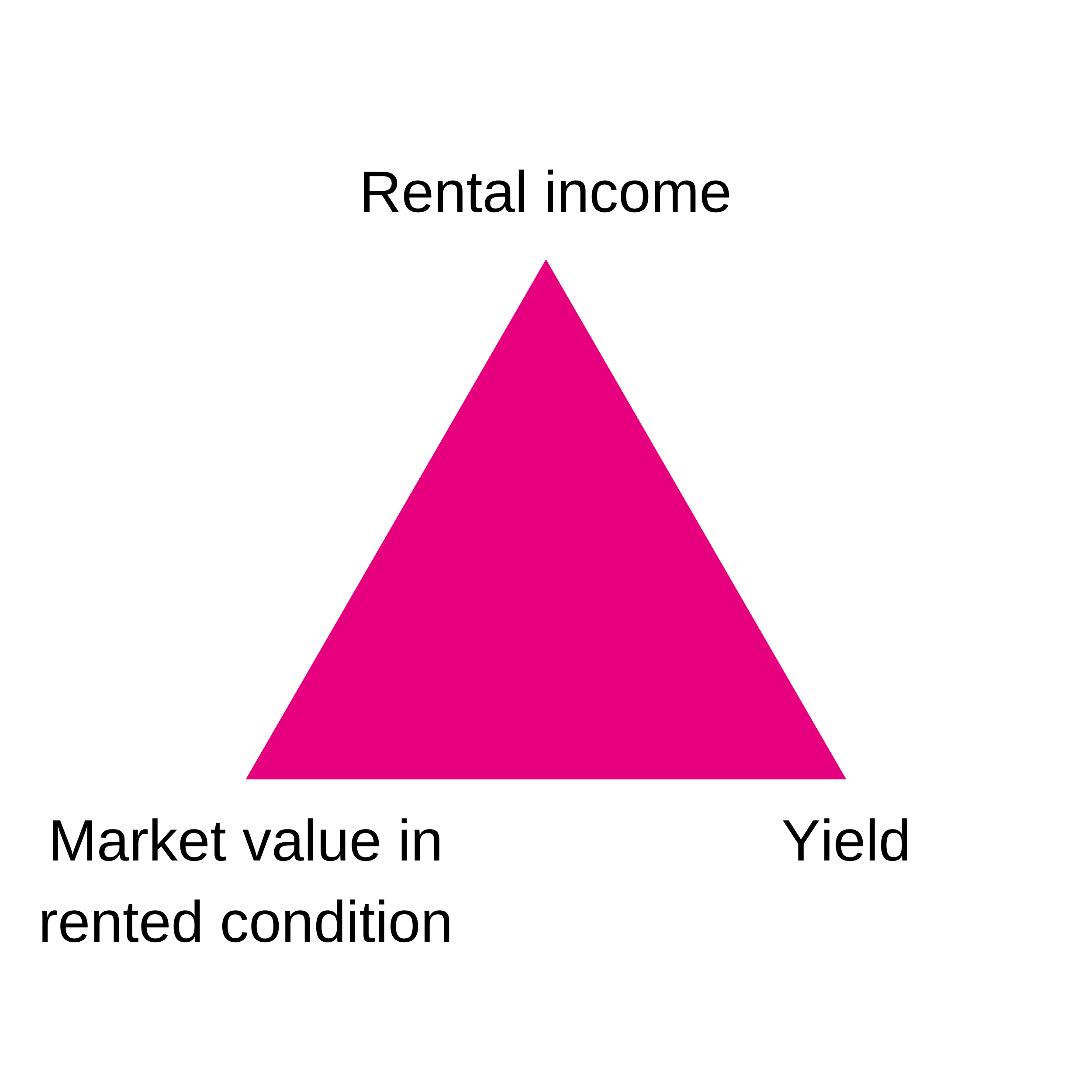

Calculate the value in rented condition yourself

You can do the calculation yourself in a few minutes if you have the right knowledge. If you know what the value is, you can request a real estate financing with a better substantiation, and the calculation also provides insight into the accrued value. of your real estate portfolio.

Value rental property is often lower

A rented house is usually worth less than a house that is empty or where you live. For example, a house worth 200,000 euros can have a rental value of 180,000 euros. This has a reason. If the landlord does not fulfill his or her obligations, the house cannot simply be sold to someone for their own use, since there is already a tenant in it. He or she enjoys rent protection. The financial risk for a lender is therefore greater and the value of the property is therefore less. From this background, lenders ask real estate investors to also invest their own money when taking out a home rental mortgage.

Reference buildings and point system determine the value

Reference properties are important to determine the value of a home. These are comparable properties in the region that resemble the intended rental home. Sometimes it is difficult to compare, because the number of rented homes sold is lower than the number of ‘normal’ owner-occupied homes. A specialized appraiser can provide more insight into this. In addition, the points system is important for the value of the home: the points of a rental home determine the amount of the rent.

Importance of rental property valuation

The valuation is necessary to provide a complete and realistic picture of the rental income and risks. A valuation report provides insight into the municipal rental rules and the rent that you as a landlord can ask. Bliss works with appraisers who are specialized in the home rental market.

Value-determining factors

Below we provide an overview of the factors that are important in determining the market value and market rent of a home. This overview is not complete. It is intended to give you an idea and a feeling for the realization of the value and which factors play a role in this.

Location

Location, location, location is a golden rule in the real estate world. The location of a property is one of the most determining factors. A house in the Randstad with a lot of employment opportunities and where the demand for housing is high has a higher value than a house in a shrinking region where demand is declining and the chance of vacancy is considerably greater. Facilities also play an important role. Think of the presence of schools, shopping centers and public transport.

Type of home

The type of home and the size of the home are of course also of great importance. Is it an apartment or single-family home? And what is the surface and volume of the house? It is important to think carefully about the target group you have in mind as a landlord and also to research the market for this target group. The better you understand your customers, the better you can meet their needs.

Marketability collateral

If the collateral is in demand, the property will be more marketable. For a house that is marketable, the market value will therefore be higher. This has to do with the law of supply and demand and in addition, if necessary, a current home will also be sold quickly if the lender makes use of the right of summary execution.

Construction condition

The structural condition of a rented house is of great importance. As a real estate investor, you don’t want to buy a cat and make a bad investment. At Bliss we therefore recommend that you always have a construction inspection carried out by an expert. In a home for personal use, the owner can be satisfied with a home that has not been properly maintained. But when renting out, the tenant can expect to rent a decent home. A house with a poor structural condition will usually yield less rent or entail higher maintenance costs. As a result, the return is lower and therefore also the value of the home.

Operating costs

The costs of owning a rented property play an important role. These additional costs for management and maintenance can have an impact on the net return of the investment property. The premium of a home insurance and costs that have to be paid to the VVE naturally affect the real return on an investment.

Purpose property

When the buyer has plans for transformation or renovation of the house, it is important to look carefully at the zoning plan and the possibilities to actually implement these changes. Renovated homes usually have a higher rent.

Sustainability and energy

The amount of the rent is determined, among other things, by the energy consumption of the home. The more energy-efficient the home is, the higher the rent can be. When determining the rent, the energylabel is used, which must be present when the home is rented out. The improvement of the energy label can ensure that a home falls just above the liberalization limit. As a result, an investment in making rented property more sustainable yields both a higher direct and indirect return.

Restrictive rights

Restrictive rights can negatively affect the value of the home. A limited right is a right derived from a more comprehensive right, which is encumbered with the limited right (article 3: 8 CC). Think of rights of use, such as the right of superficies and the right of usufruct.

Market value in leased condition important for application for rental mortgage

Would you like to know more about the market value in rented condition of real estate that you wish to purchase for letting? At Bliss we are happy to help you with this. Valuation and financing are closely related. It is therefore of great importance to gain insight in advance into the current market value. At Bliss we assist with applying for a valuation report. This way we know how much equity you have to contribute and that the report by the provider of the desired buy-to-let mortgage is accepted.